Hey reader,

The remote work lifestyle is an incredible way to live. As a laptop warrior, or digital nomad, or remote worker, or whatever you want to label yourself, you have incredible freedom to build your life around the things that are important to you.

But there’s a fine line between being location independent and simply being unemployed. Investing in the companies, things, and causes you believe in, and that have promising returns, puts you firmly on the location-independent side of the spectrum, even as contracts and clients come and go.

To me, this lifestyle is all about getting outdoors in the mountains and exploring. It means traveling when and where I want to, and working along the way. It’s about living a healthy, active life that is both productive and fulfilling, in both professional and personal settings.

Of course, one has to somehow pay for this lifestyle. I’m going to discuss my strategies for one aspect of the finances behind the optimized remote lifestyle today — investing.

Today’s essay is in response to several comments I received after a dispatch I wrote back in May about two fintech apps I use.

Let’s get to it.

Community shoutouts

In lieu of the normal shoutout section, this week I want to ask for your stories. As those of us who’ve been working remotely for a while know, things sometimes get lost in translation.

Funny stuff happens. Personally, I find that many of these moments aren’t even work-related.

Take the remote work dress code, for example. I regularly work in sweatpants and the t-shirt I slept in the night before. Little to no effort required there. But when I do have somewhere to go, I tend to overdo it — perhaps putting on a nice button-down shirt and my fancy black scally cap to go grab something to eat or to walk up the street for a beer, simply because I’m so excited to have somewhere to go.

I then feel ridiculously overdressed while standing in line for a sandwich in my super-casual Colorado town — especially when I see someone I know, and that person knows that I sit in my house all day staring at a laptop.

What are your funniest/weirdest odd-ball moments of the remote work lifestyle? Hit reply and let me know!

Best answers get a shout-out in an upcoming newsletter focused on this topic.

Moving on

Now for the meat and potatoes 🥔 — as Dan Andrews from my fav podcast, Tropical MBA, is known to say.

We’re here to talk investing. In particular, investing for remote lifestyle optimization.

Below I outline each of my current strategies and why I believe in it.

I’ll preface by saying that I first got into Vanguard and all of the below after getting hooked on the blog Mr. Money Mustache a few years ago. Pete, the guy behind MMM, is part of the FIRE movement — an acronym for Financial Independence Retire Early.

I myself am not yet there, and am not here to tell you how to get there. I’m not a financial advisor. But what I’ve gained from his blog and others, along with additional research I’ve done outside of the FIRE space, has revolutionized how I think about investing.

I am also not here to sell you on that theory. I think it’s worth reading up on and understanding, but much like all of the “how to quit your job and become a digital nomad” blogs on the internet, there’s a lot of fluff surrounding only a few key takeaways. And like most bloggers promoting their way of life, FIRE bloggers are hyping up something that isn’t attainable for the vast majority of people.

Regardless, this is what I’ve put in place.

Vanguard Index Funds

Vanguard founder Jack Bogle shook up the stock market when he founded the ETF firm in 1975. By combining top-performing stocks, companies, and futures into one easily-buyable portfolio, Vanguard index funds have all but eliminated the need for professional portfolio oversight.

The concept of index funds or ETFs (exchange-traded funds) is the backbone of the Financial Independence Retire Early (FIRE) movement. Their modus operandi is built on the 4 percent rule, also known as the 25x rule. This line of thought states that in order to obtain financial independence, you need to save 25 times the amount of money you need to live on for a year. Invest that money in index funds, and you can — theoretically — live comfortable on a four percent drawdown of that money, forever.

This of course requires the market to go up by 4 percent every year, on average.

I do not endorse or participate in this line of thought. But reading about it did introduce me to Vanguard funds, particularly VTI and VXUS, and convinced me that I should buy into them heavily.

These funds are low risk and go up with time, as they tend to hold the top performing assets in a certain class. Or, in the case of VTI, in all of the classes together — VTI is a total stock index. So you’re buying Apple, Tesla, Google, and all the other big players at once.

I chose Vanguard. Others prefer Betterment, BlackRock, or other portfolios.

Percentage of portfolio: 25%

Value add: long-term passive investment that is low-risk when compared to equity stocks.

Renewable Energy and Electric Vehicle Stocks

In my TDAmeritrade account, I make one major exception to my “ETF only” rule.

That exception is based on a little principle I call “buy the future.” It’s also the action behind my desire to become an “impact investor,” (discussed in this earlier dispatch) even though I don’t have the money to be a VC or an angel investor.

The future, as anyone paying attention is well aware, is renewable energy and electric vehicles.

(I’m not going to get into the politics or beliefs behind this. This belief is in no way a slight to any who work, or have worked, in oil and gas — we wouldn’t be where we are as a society without you. But I will say this — no matter what your politics, career, or beliefs, if you do not see the renewable, electric future, you’re f*king blind.)

The principle I named above outlines my humble perspective on investing. To win is to think big picture, long term. Governments and businesses the world over are setting ambitious targets to cut or eliminate carbon emissions. Today, the US House of Representatives will pass the most revolutionary climate bill the US has ever seen, and send it to President Biden’s desk to become law.

Again, regardless of your politics, this is already impacting us: My TDAmeritrdae portfolio is up nearly 15 percent in the last week, and the bill isn’t even law yet. The future looks bright.

The US goal of reaching net-zero emissions by 2050, set during President Biden’s climate summit in early 2021, is being increasingly replicated around the globe.

The companies that are going to make this possible are those pushing boundaries in solar, wind, nuclear, and other forms of renewable energy. Additionally, companies like Climeworks are powering a revival in carbon sequestration, and even some banks are getting in on the action. Getting in on these companies when they’re young, shortly after they list on a stock exchange (if they do — Climeworks, we’re waiting), can provide incredible value to you and the funds these important companies need to succeed.

In short, the companies that are going to see three-and-four-X growth in the energy sector over the coming decade are in the renewable space.

It would take too much room to cover all the promising renewable energy and EV stocks here in this article. Fortunately, Investopedia maintains a great list of both:

Of course, we can’t overlook EV charging companies like Blink and Electrify America. And the companies producing the batteries that these cars require are going to go up in value, as well.

Respected companies in these fields that have yet to see massive increase over the past couple years is a good bet, in my opinion, if you’re willing to take a bit of risk and are willing to wait several years or more to see your reward.

A few I believe in:

Blink Charging (BLNK)

Next Era Energy (NEE)

Atlantica Sustainable Infrastructure (AY)

SunRun (RUN)

There are ETF options here, too, including Invesco Solar ETF TAN — a solar energy index that as of the time of this writing is up 300 percent over the past 18 months. Another is iShares Global Clean Energy ETF (ICLN). I’ve bought into both.

Percentage of portfolio: 10%

Value add: Buy the future — not the present. And, do some good with your dollar while you’re at it.

Qapital Invest

If you’ve subscribed to this newsletter for while (if not, see button above!) you may remember this earlier post that was almost entirely about Qapital. This app is the single best fintech product I have ever used.

In fact, it has revolutionized my entire approach to saving money.

Simply put, there’s no easier way to automate your savings and automate your investing.

Qapital works like this. You sign up (it used to be free, but the basic plan is now $3 per month, the Complete Plan is $6 per month). Options include basic savings and spending accounts (opened through a third-party bank), with options to create savings targets to help you reach specific goals like paying off your car or going on that sweet trip to Morocco that you’ve talked about for years.

The app will prompt you to set up a recurring deposit from your traditional bank, direct deposit, or another banking platform to come into your Qapital accounts.

I have a savings account where I have recurring automation set for $30 per week, as an example.

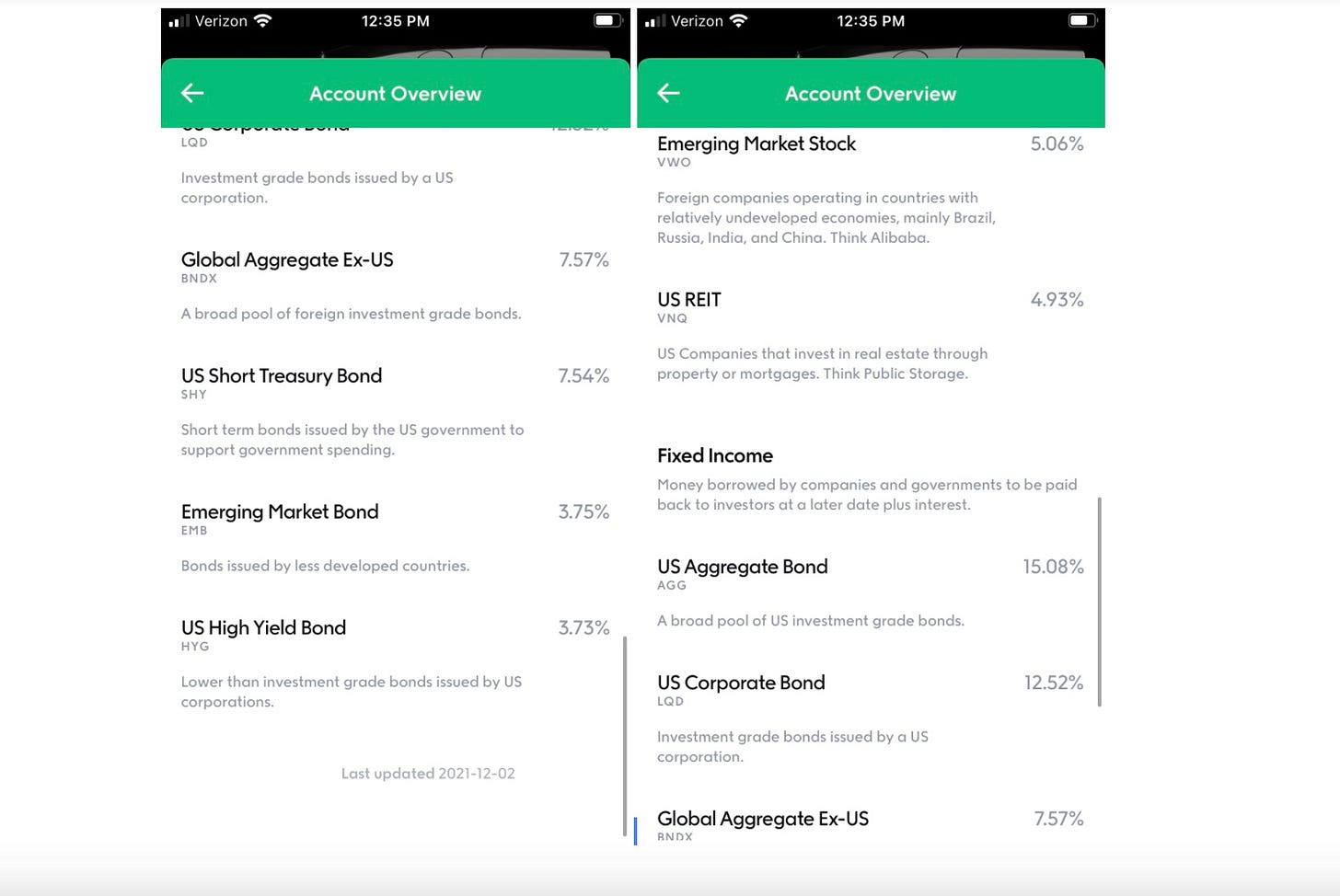

But the best part of Qapital is its investment feature. I highly recommend setting up a Build Wealth plan through Qapital, and setting an automated recurring transfer from your checking account into this Build Wealth investment account (called Set and Forget).

It basically works like a managed investment portfolio. You choose your risk level. Your money goes into assets based on that risk level which include US and Foreign Large CAP funds, Mid Cap funds, and Small Cap funds (basically large businesses, mid-sized businesses, and small businesses).

Some goes into REITs (real estate investment trusts). Some goes into US aggregate bonds, corporate bonds, and foreign bonds. And it’s all automated, with no effort required on your part.

The Set and Forget rule means you’re investing every week (or whatever frequency you choose). The app prompts you to set a goal, and will pull a set amount each time based on what the general market trends say will get you to that goal in the amount of time specified.

For example, let’s say you want to save $50,000 in five years. With accrued gains, that breaks down to $169 per week, every week, for five years.

$50,000 sounds like a lot of money when you’re first starting out — but if you have regular income that exceeds your monthly cost of living, $169 per week doesn’t sound so bad, right?

It’s incredible how fast it all adds up. I have a target set and after three years, my account is slightly ahead of schedule. I plan to continue for an additional five years after the first five-year term is complete.

Having a six-figure total sitting there after a decade of doing nothing sounds pretty good, eh?

Percentage of portfolio: 15%

Value add: super passive, good returns, mid-level to low-level risk, with automated weekly deposits

REITs (and real estate)

I use another FinTech app called Fundrise for REIT investing. If you skipped the above section (def go back and read it), REITs is an acronym for Real Estate Investment Trusts.

This is in addition to the house I own in Palisade, Colorado, with my wife and daughter.

REITs are effectively the index fund version of real estate investing. You buy into large-scale real estate projects like apartment complexes, rental subdivisions, commercial properties, etc., and you own barely a small slice — but because there are hundreds or thousands of people in there with you, it’s enough to make big-time purchases.

The REIT holds the purchase for a set amount of time, and then sells it — generally at a profit.

I first signed up for Fundrise in July of 2019 with an investment of $5,000.

Then, I did nothing for two years. In mid-2021, the value hit $6,000, a 20% return in two years with no effort required on my part. During that time, I did put in the effort of studying up more on REITs and Fundrise and talked to several people who had invested more heavily than myself in the platform or knew people who had.

I gained confidence in the overall REIT market, though the perspectives on Fundrise specifically were mixed.

A couple people noted the difficulty in retrieving funds due to the app’s structure of paying out returns slowly over time, and by reserving the right to hold payments during times of market stress.

Still, I felt confident enough to invest another $5,000 to reach the platform’s upper-tier level (which requires a minimum $10,000 investment with the bait of better and faster returns).

Like Qapital, Fundrise prompts you to set up recurring deposits to reach a set target wealth goal, and will do all the math for you to make it super easy and passive.

Those already invested in either Qapital or index funds may call out here that you already have money in REITs through those investments. This is true.

But as multiple high-authority sources — including Delta Wealth Management and Logan Freeman of the Compression Podcast — have noted, 25 percent of your total portfolio should be dedicated to real estate. Or more, in some cases.

Motley Fool’s Million Acres blog notes that 10 percent — or up to 40 percent of your total real estate holdings — should be invested in REITs specifically.

I like this assessment. REITs will never accrue value as fast as buying property in a market that turns hot. But they’re also far safer in the long term when the market dips, because the money is split into multiple properties in multiple markets.

As one market goes down, another will go up. And because REITs are typically managed by experienced professionals whose entire job is to assess market risks and move money into rising markets, the risk is far less for the investor.

Best of all, it’s entirely passive on your part — despite the fact that it’s a managed investment.

Percentage of portfolio (including home we live in): 50%

Value add: easy and passive way to invest in real estate around the globe

Digging this post? Please share using the button below! It’s the best way to help this newsletter grow.

Giving back through lending

I recently signed up for a platform called Steward, which offers loans in the regenerative agriculture space, typically to small farmers and ranchers who produce food using regenerative farming practices. To read more on why regenerative farming is important, I recommend following Civil Eats.

Steward loans have a 9-month maturity with a 4 percent “dividend,” meaning you get back 4 percent more than you loaned. All you have to do is connect your account and lend however much you wish to, and that money goes straight to farmers who need it to scale their projects.

The end game

The end game is, of course, to accrue enough wealth that you become financially independent — i.e., you are comfortable enough that you don’t have to work a job to survive.

I refer to this as my Freedom Line (another one stolen from Dan Andrews — check out his book Before The Exit).

My plan, if and when I reach it, is to accrue enough wealth that I can pursue passion projects only. For me, this looks like writing gigs that cover or promote things I believe in, book writing, advocating for sustainability initiatives, and a boatload of volunteer work with the food bank my wife runs (or with whatever heroic cause she is currently dedicating herself to when we get to this point).

For this to happen, you must be able to cover your basic financial costs on the dividends and payments you make from your investments. And/or, by cashing out some of your portfolio to cover things like paying off a mortgage.

This takes time. Dividends are a very small percentage of the total asset investment. Vanguard, for example, pays about 25 cents quarterly per $100 invested, give or take and depending on which fund you buy into.

Once you build your portfolio to the point where dividend payments are meaningful (i.e. a few hundred bucks rather than a few dozen), you’re really ready to rock.

No, not “rock” by pulling those dividends out and living on them. “Rock” by continuing to reinvest them into more Vanguard shares.

Eventually, after years and years of hard work and disciplined investing, and a million thoughts about whether everything is about to collapse, you’ll reach a point where your dividends are in the thousands of dollars per quarter. THEN you may be ready to cash in on them, if you want to.

Cheers to finally reaching the Freedom Line — someday.

Mountain Remote news and further reading

Fittingly for today’s essay, I’m happy to say that a portion of the limited revenue generated by Mountain Remote goes directly to Frontier Climate through Stripe’s climate initiative.

I reviewed the Erem Xerocole hiking boots for Matador Network, the first biocircular hiking boots on the market.

And I wrote about how to get into mountain biking for Cool Material, my first piece for the publication.

That’s it for this week, see you next time!